Nonprofit Telemarketing Trends 2018-2023

As the world emerged from the COVID-19 pandemic, nonprofits faced an altered landscape for fundraising and audience engagement. From the profound silence that fell over performing arts venues, to advocacy groups responding to developing crises, nonprofits of diverse missions shared a common lifeline: the generosity of supporters.

This report takes a comprehensive look at over 200 telefundraising and telemarketing campaigns managed by DCM from 2018 to 2023, reflecting our work with 50 nonprofit partners whose annual budgets range from $9 million to over $100 million.

The results shed light on key post-pandemic trends across the advocacy, political, performing arts, and culture sectors.

-

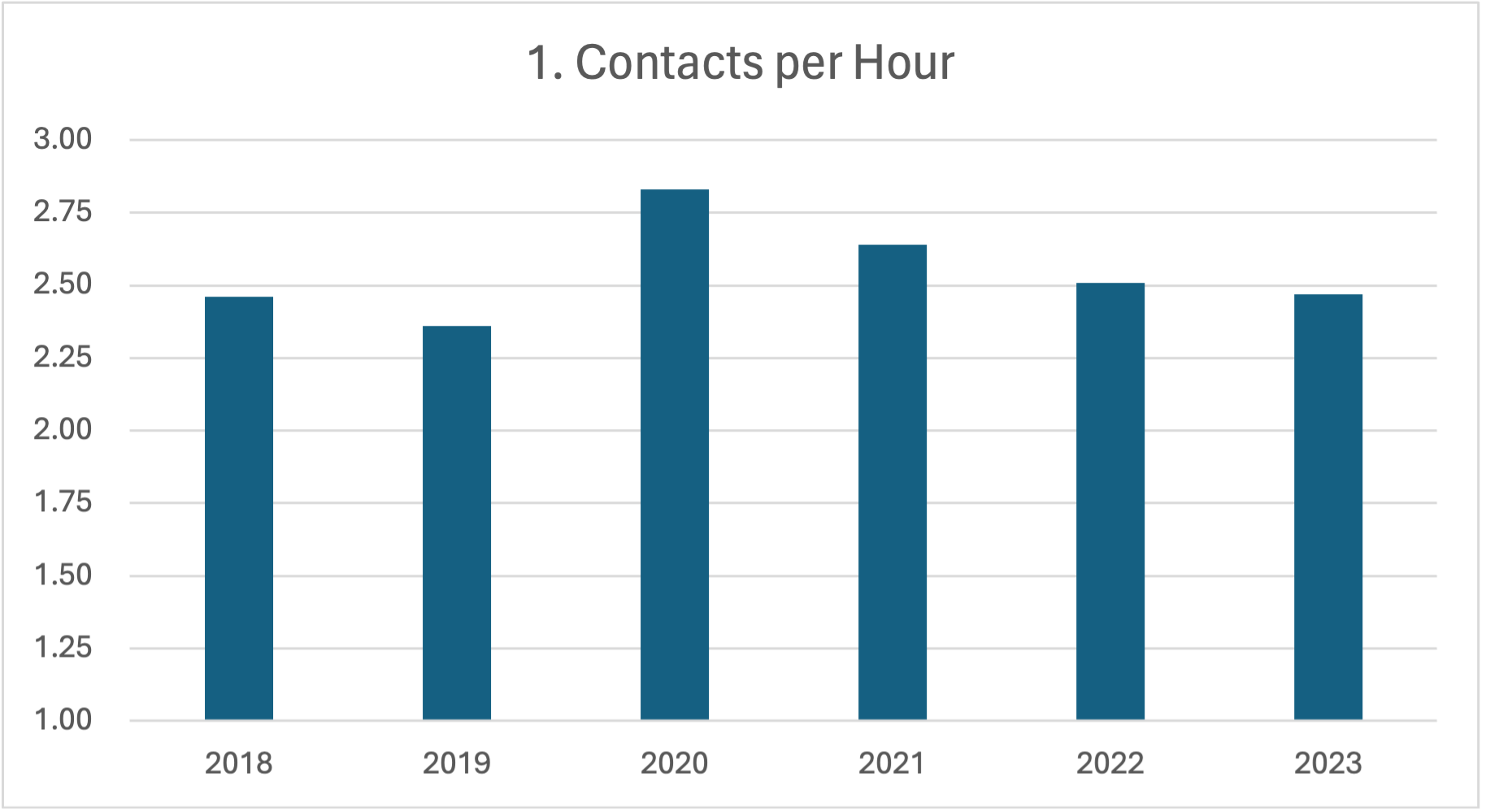

Contrary to assumptions, people are still answering phone calls from nonprofits. Contact rates increased in 2020 and 2021 as people craved personal interaction amid isolation. This affirms that telemarketing is not just an avenue for generating revenue, but also for maintaining donor and subscriber relationships and building personal connections.

While this pandemic-driven spike has subsided, overall contact rates are on par with pre-pandemic levels around 2.5 per hour (Chart 1).

-

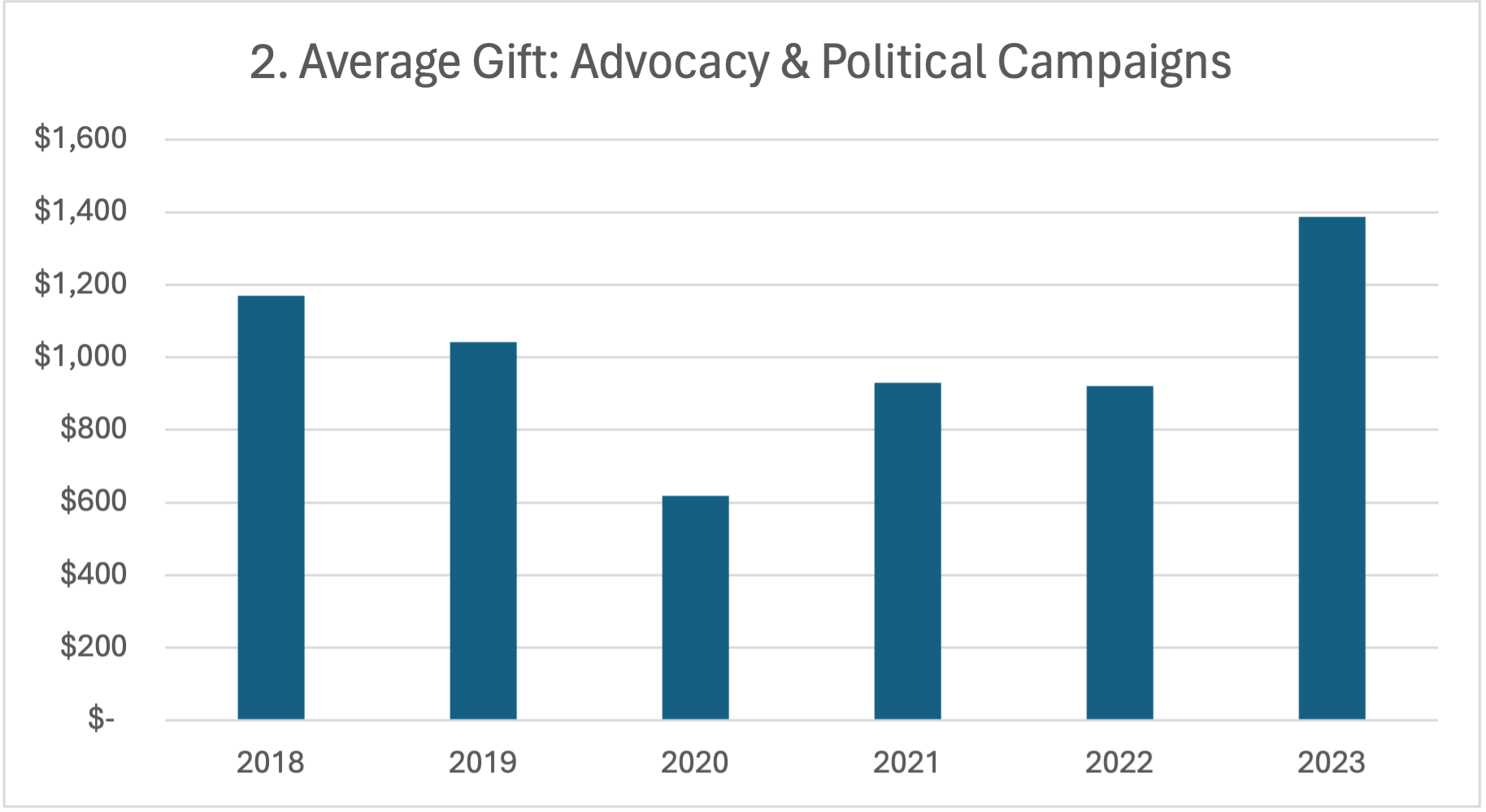

Advocacy and political campaigns have benefitted from steadily growing gift sizes over the past several years. From 2018 to 2023, the average gift amount for these high-touch, mid-level campaigns jumped 19%. Even more impressive, from the lows of the pandemic to now, the average gift size has more than doubled (Chart 2).

While fundraising results fluctuate with election cycles and current events, this upward trend indicates an engaged base ready and eager to give.

-

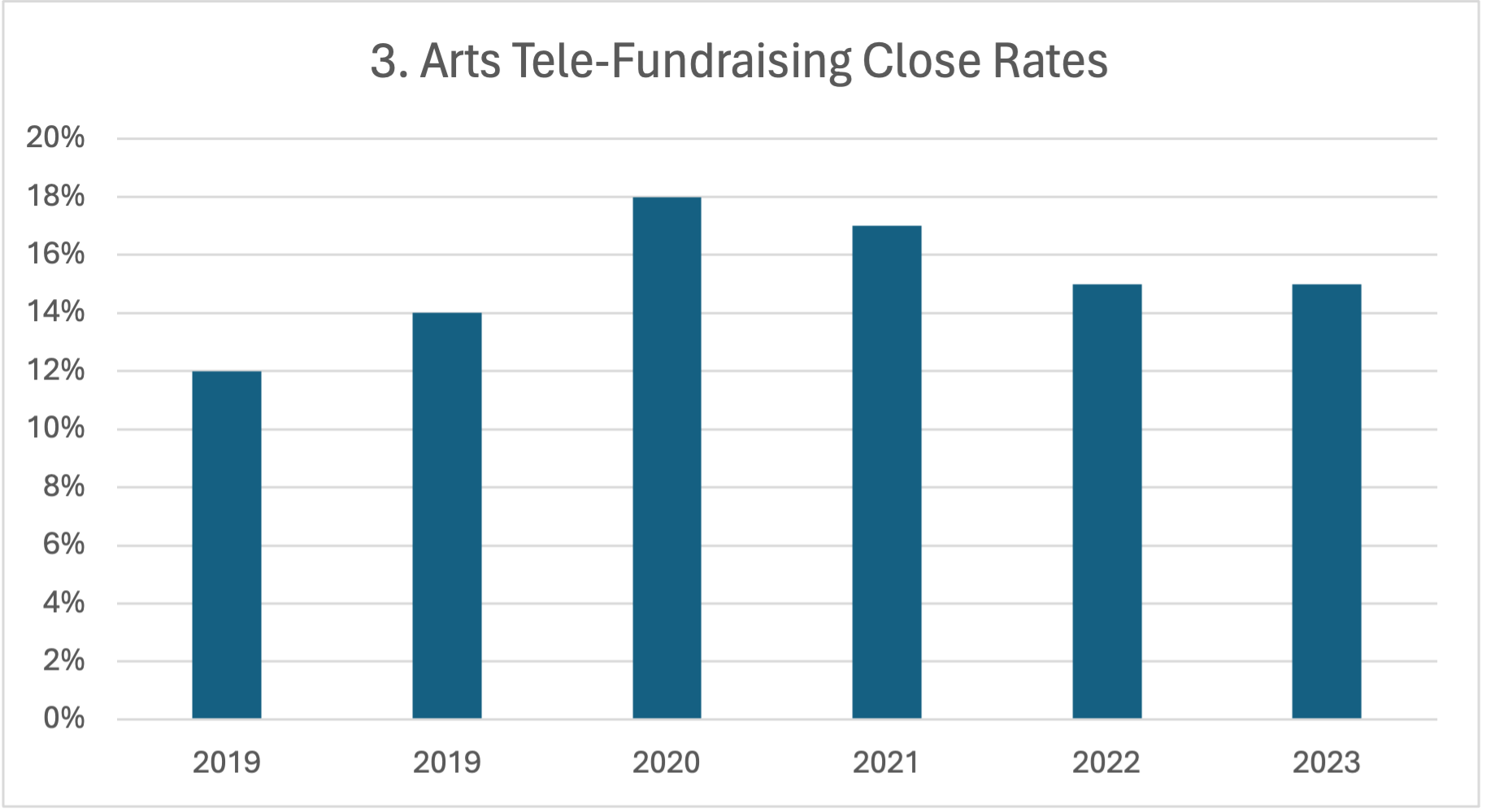

Arts and culture telefundraising campaigns remained strong over the past 5 years. Fundraising spiked during 2020-2021's precarious closure and reopening phase and has now settled just slightly above pre-pandemic levels (Chart 3).

Arts fundraising has also shown considerable consistency in terms of gift size, with an overall average gift remaining between $250 and $300 across the past five years. Overall, the loyalty of arts donors continues to shine through, even in the most volatile times.

-

The pandemic created unparalleled challenges for selling subscriptions over the phone, eroding databases of previously loyal buyers and subscribers. With diminished audiences due to extended pandemic closures, the average number of orders per campaign plummeted (Chart 4).

However, as organizations have returned to normal operations, there are clear signs these vital campaigns are rebooting. Since reopening, subscription sales have seen a steady, albeit slow, rebound. Early 2024-2025 season results provide even more optimistic signs, with renewal close rates nearing pre-pandemic levels.

Looking Ahead

As we all know, continued growth hinges on smart investment. Looking ahead to 2024 and beyond, evolving strategies including peer-to-peer texting, enhanced technology, and data modeling all need to be tested, enhanced, and fine-tuned to generate optimal results. While some areas have fully rebounded and others continue rebuilding post-COVID, overall indicators suggest the nonprofit telemarketing and fundraising landscape is regaining solid footing.

Want More?

For deeper insights, benchmarks, and more, contact your DCM Strategist or Amanda Zook, Director of Business Development.

Definitions

Contact = A call that is answered and results in a resolution (i.e. a “yes” or a “no”). These statistics reflect contact rates using a manual click-to-dial system for high-touch calling and exclude the use of an auto-dialer.

Close rate = the number of gifts divided by the number of contacts.